Tycker du att investeringar är svårt? Det behöver det inte vara. Du kan lära dig en hel del från några av historiens främsta investerare. Läs mer i detta inlägg om visdomsord i form av mina 10 favoritcitat om investeringar!

Tycker du att investeringar är svårt? Det behöver det inte vara. Du kan lära dig en hel del från några av historiens främsta investerare. Läs mer i detta inlägg om visdomsord i form av mina 10 favoritcitat om investeringar!

Att investera behöver inte vara så svårt som en del gör gällande. I själva verket kan investeringar göras på ett förhållandevis enkelt sätt. För att belysa detta har jag satt ihop en lista med mina favoritcitat från några av historiens främsta investerare.

De inspirerande och tänkvärda citaten om investeringar kommer från välkända investerare och omfattar ämnen som ligger mig varmt om hjärtat såsom t.ex.

- Indexfonder

- Diversifiering

- Långsiktighet

- Låga avgifter

- Riskminimering

- Enkelhet

Här nedan återfinner du ett urval av mina favoritcitat om investeringar. Citat från erkänt skickliga investerare som på ett träffsäkert sätt sätter ord på inspirerande tankar.

"Track and mimic the investment strategies of the highly successful Harvard and Yale endowments. Using the endowment Policy Portfolios as a guide, the authors illustrate how an investor can develop a strategic asset allocation using an ETF-based investment approach. Reduce their risk by using a tactical asset allocation strategy to protect them from bear markets. Follow the smart money and piggyback the top hedge funds and their stock-picking abilities."

Mebane T. Faber - The Ivy Portfolio

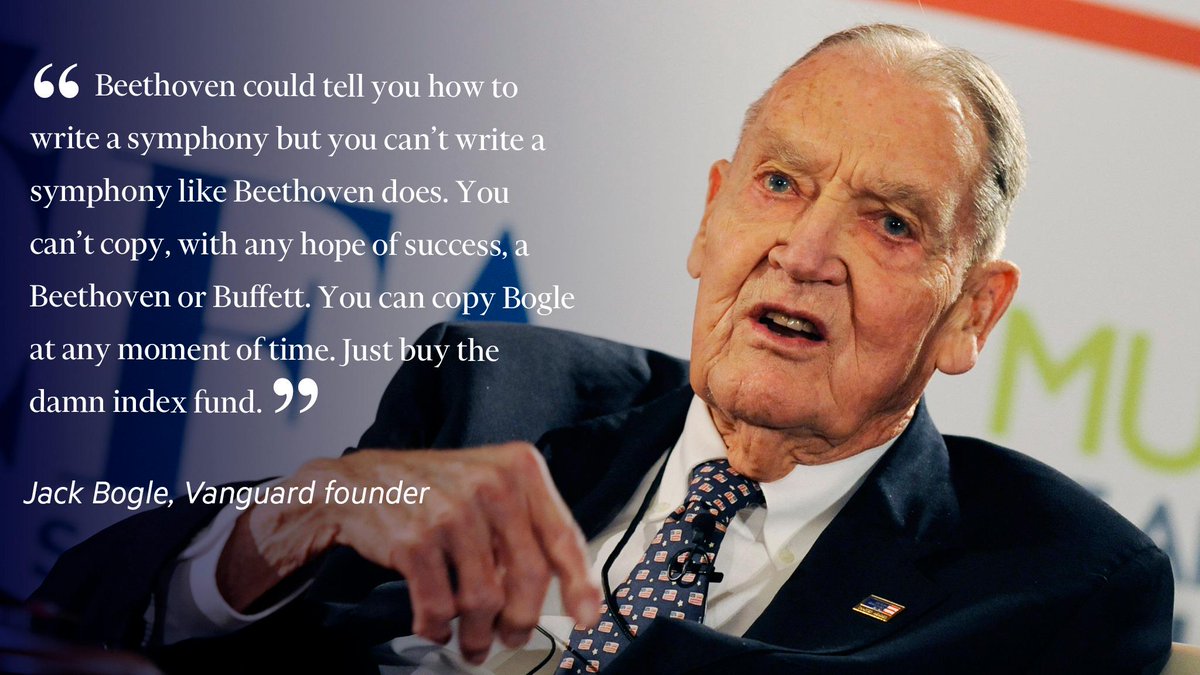

“Beethoven could tell you how to write a symphony but you can't write a symphony like Beethoven does. You can't copy, with any hope of success, a Beethoven or Buffett. You can copy Bogle at any moment of time. Just buy the damn index fund.”

Jack Bogle, Vanguard founder

“Whatever the investment objectives, the investor who is wise diversifies.”

Burton G. Malkiel – A Random Walk Down Wall Street

“I´ve said: “Stay the course” a thousand times, and I meant it every time. It is the most important single piece of investment wisdom I can give you.”

John C. Bogle - Common Sense on Mutual Funds

“With relatively little effort, you can design and assemble an investment portfolio that, because of its wide diversification and minimal expense, will prove superior to most professionally managed accounts. Great intelligence and good luck are not required. The essential characteristics of the successful investor are discipline and stamina to, in the words of John Bogle, “stay the course”.”

William Bernstein - The Four Pillars of Investing

“Don’t try anything fancy. Stick to a simple diversified portfolio, keep your costs down and rebalance periodically to keep your asset allocations in line with your long-term goals.”

David Swensen, Yale Endowment CIO.

“Most investors are primarily oriented toward return, how much they can make and pay little attention to risk, how much they can lose.”

Seth Klarman, Baupost

"Most investors, both institutional and individual, will find that the best way to own common stocks is through an index fund that charges minimal fees. Those following this path are sure to beat the net results (after fees and expenses) delivered by the great majority of investment professionals."

Warren Buffett, Chairman of Berkshire Hathaway

"The only way to "beat an index" is to invest in something other than the index. Why would you, when the only source of long-term risk and return data is the index?"

Mark Hebner, Founder, Index Fund Advisors, Inc.

"To reduce risk it is necessary to avoid a portfolio whose securities are all highly correlated with each other. One hundred securities whose returns rise and fall in near unison afford little protection than the uncertain return of a single security."

Harry Markowitz, Father of Modern Portfolio Theory